Our Verdict

4.0

Lincoln Financial has some of the most competitive underwriting tables for an assortment of health conditions, making them the best life insurance for someone with substandard medical situations.

I put this Lincoln Financial Life Insurance Review together, to help you understand if this product is best for you and how it works.

Pros

Cons

I am a huge advocate of the no medical life insurance option; however, there are some situations where the fully underwritten option is best.

Especially if you have pre-existing conditions such as diabetes or high blood pressure or need more than $1 Million in life insurance.

The best way to speed the underwriting process up will be to get your exam completed as early as possible so that your results get back to the insurance company faster.

If you need the most affordable rates and are fine with a 1 to 2 week turn around, then getting term life insurance rates and coverage from Lincoln Financial Life is the best answer.

Who Is Lincoln Financial Life Insurance?

If you are wondering if Lincoln financial has anything to do with President Abe Lincoln you would be right.

The owners of the company were able to get permission from Abraham Lincoln's Son to use his name and likeness for the logo since 1905.

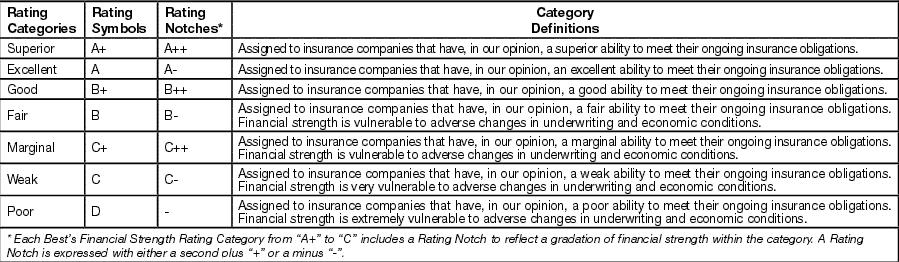

Lincoln Financial has an A+ (Superior) ranking with A.M. Best

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

Why Should You Care About A.M. Best?

I like to think of A.M. Best like the JD Power of the insurance industry, they have been around for over 117 years.

They rate companies based mainly on their financial strength, which can be an indicator or claims-paying ability.

Claims Paying Ability "in plain English": A Life Insurance Company's ability to pay out on a policy.

What Makes Them Different?

Something that makes Lincoln Financial different is that they offer term life with a simple phone interview application.

Most people will be able to qualify for coverage quickly without getting medical exams.

They also have a universal life policy that has a long-term care option attached to it.

They have an assortment of universal life and indexed universal life insurance policies, including a survivorship indexed product.

A survivorship life insurance policy (aslo called a "last to die" life insurance policy) insures two people, typically a married couple, on one policy. The policy pays out when the second person dies.

INSURANCE WHERE YOU LIVE

Life insurance by state.

">How Does Lincoln Financial Life Insurance Work?

Lincoln Financial, is focused on affordable life insurance rates with solid underwriting for people that have sub-standard health.

Their life insurance process works like this:

Electronic Application

The application process is electronic, simple and short, it will usually take less than 5 to 10 minutes to complete all the information and submit your application.

Fast Underwriting With Phone Interview

Lincoln Financial's underwriting process is a bit faster than most insurance companies because they allow for a telephone interview underwriting process.

If you qualify, you can be approved in a matter of days instead of weeks with this underwriting process.

Policy Delivered Via Email

Once your policy has been approved and issued you will receive a copy of it directly to your email address.

This is great because you don't have to remember where you left your policy and will always have easy access to it.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

What Does Lincoln Financial Cover?

Lincoln Financial life offers a few different policy options for you to choose from.

Their policies range with coverage options from $100,000 up to $3,000,000.

10 Year Term Life Policy

The ten year term life option is going to cover you for 10 years before it's time to purchase a new policy.

This policy is going to be the most affordable option with low-range pricing and will be best for people who are looking at both their short term and long term needs.

The amount of life events that can happen in 10 years is massive and being prepared for them is very important.

A 10 year term is a great starting point and locking your low rates in is going to be essential.

15 Year Term Life Policy

The fifteen year term life option is going to cover you for 15 years before you have to purchase a new policy.

This policy is going to be the second most affordable and be best for people who are in the middle of life events like having a baby or switching jobs.

20 Year Term Life Policy

The twenty year term life policy will be the second most expensive of the 4; however, it will still be very affordable.

This term length is going to be best for someone focused very much so on their future and want to be covered for the most extended period of time with the maximum amount of savings.

The longer a term length a policy has, the more expensive it will be up-front; however, the more savings you will get over time.

If you know what you want and can afford the twenty year term option, then I would suggest you go with the 20 year term option.

30 Year Term Life Policy

The thirty year term life policy will be the most expensive of the 4; however, it will still be affordable.

This term length is going to be best for someone focused on their future and want to be covered for the most extended period of time with the maximum amount of savings.

The longer a term length a policy has, the more expensive it will be up-front; however, the more savings you will get over time.

If you know what you want and can afford the thirty year term option, then I would suggest you go with it.

It's a really good option if you just purchased a home.

All Cause Death Benefit

All of these policies will pay out for all types of death from accidental death, terminal illness, critical illness or chronic illness.

With all insurance policies, there are some limitations so be sure to read the policy for things that aren't covered.

Lincoln Financial Life Insurance Products

Lincoln Financial has two primary term products, the TermAccel® and the LifeElements® and we detail them below:

Lincoln TermAccel®

The Lincoln TermAccel® product allows you to apply for coverage through a complete electronic process.

You get the best rates at a super fast speed from a top life insurance company.

You can also convert this policy into a whole life policy by following the below guidelines:

Convertible prior to the end of the level premium payment period (10, 15, 20 or 30 years) or prior to insured’s attained age 70, whichever comes first. Ask your advisor what opportunities may apply to you.

Some of the optional riders available are:

Waiver Of Premium Rider - For an additional cost, if you become totally disabled as a result of a qualifying event, premiums are waived.

Accelerated Death Benefit Rider - You can accelerate a portion of the death benefit if you've been diagnosed with a qualifying terminal illness that is likely to result in death within six months.

Children's Level Term Rider -Available at an additional cost, provides level term coverage for all children of the insured.

The TermAccel policy is going to be the best option for you if you want a no exam product.

If you are fine with an exam, or need more than $1 Million in coverage then you might want the Lincoln LifeElements product.

Lincoln LifeElements®

Lincoln LifeElements® Level Term still provides a fast underwriting outcome with the phone interview application.

However, if you need a larger coverage amount this is going to be the best product for you.

You can also convert this policy into a whole life policy by following the below guidelines:

Convertible prior to the end of the level premium payment period (10, 15, 20 or 30 years) or prior to insured’s attained age 70, whichever comes first.

Some of the optional riders available are:

Waiver Of Premium Rider - For an additional cost, if you become totally disabled as a result of a qualifying event, premiums are waived.

Accelerated Death Benefit Rider - You can accelerate a portion of the death benefit if you've been diagnosed with a qualifying terminal illness that is likely to result in death within six months.

Children's Level Term Rider -Available at an additional cost, provides level term coverage for all children of the insured.

INSURANCE WHERE YOU LIVE

Life insurance by state.

">Lincoln Financial Life Rates & Comparisons

Just to give you an idea, below I wanted to compare Lincoln Financial rates some of the top 10 best life insurance companies.

A 20 Year, 500,000 Term Policy for a 30 year old male in perfect health and a non-tobacco user, see the results below:

Company Name | Plan Name | $500,000 Quote |

|---|---|---|

Classic Choice Term | $20.21/month | |

Pacific PROMISE Term | $20.84/month | |

TermAccel | $21.00/month | |

Select-A-Term | $21.11/month | |

Level Premium Term | $21.32/month | |

OPTerm | $21.44/month | |

Term Life Answers | $21.66/month | |

Haven Term | $22.48/month | |

Bestow No Exam Term | $26.25/month |

As you can see, Lincoln Life's rates are the third most affordable of all the insurance products.

If you want the lowest price and best value then the TermAccel product is your best option.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

How Lincoln Financial's Claims Process Works

According to Lincoln Financial, in order to start the Lincoln i-Claim process, you will need the following information:

Within five business days after submitting the online notification of death form, you will receive a claimant email and link to submit your claim package.

Once you have submitted your claim form, death certificate and any additional requirements through Lincoln i-Claim our claims examiners will review and be in contact with you in five business days.

You can start the i-Claim process here.

Are There Any Claim Exclusions

There are a few exclusions when paying out on a life insurance claim.

The exclusions include death from suicide (within the first 2 years of coverage), which is standard for almost all life insurance policies.

As always, please read the policy specifics when it arrives in the mail; however, those are some general exclusions which is industry standard for most policies.

Lincoln Financial Life Availability & Policy Options

To qualify for the Lincoln Financial term life insurance policy, you must:

How To Take Action

No other Lincoln Financial Life Insurance Reviews are as long as mine; however, I wanted to make sure that I gave as much detail as possible.

If you need less than $500,000 in coverage you can apply for their no-exam option.

I also say that if you think about the 30-day free look period, you really can purchase this life insurance risk free.

And guess what, if you don't qualify for the no exam underwriting process that is perfectly fine, you will still be able to get the lowest rates when you complete their phone interview option or an exam.

Just click on the link above to get started.