When it comes to having proof of homeowners coverage and figuring out your policy specifics, there is nothing better than a homeowners insurance declaration page.

And guess what:

Understanding the layout of the declaration page can make it much easier for you to find the information you need on your policy if you need to file a claim.

In this post today, I will go over the different parts of a home insurance declaration page, and explain what type of information you can get from each section.

Sample Homeowners Declarations Page

We have decided to break down each section of the homeowners insurance deceleration page so that you can know how each section works.

Your Basic Information

On the top left of the page you will find your policy number, you should always have this handy when making any changes to your policy or trying to file a claim.

It will also list the type of homeowners insurance policy you purchased, as well as the policy effective and expiration dates.

It also shows the named insured which will usually be yourself and the best number to reach them if you have questions.

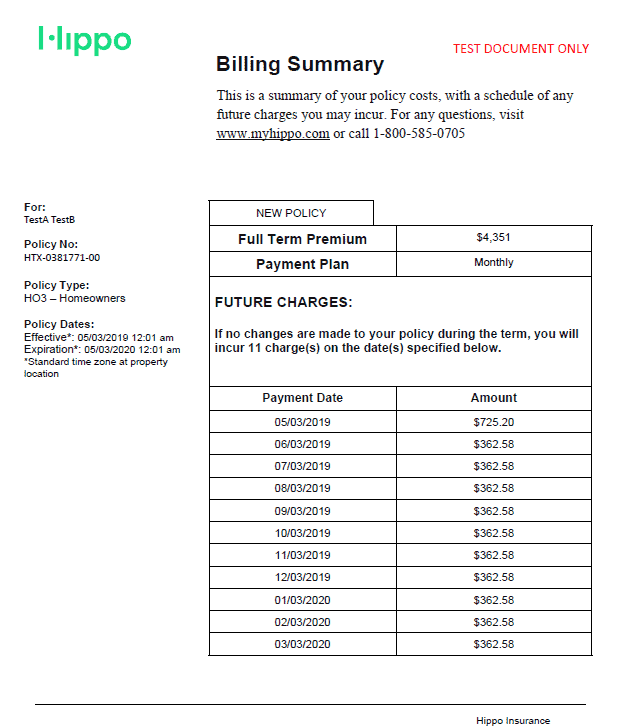

Premiums & Billing Summary

To the right of the initial page is also the premium payment and billing summary.

This section of the policy is going to cover how much your premium payments will be until the policy expires.

It is covering how much your full term premium will cost which is essentially how much you will pay during the life of the policy.

It also covers the type of payment plan you are on, either monthly, or annually.

Finally it shows you a schedule of future payments along with their due dates and monthly premiums.

THE SIMPLY INSURANCE WAY

Home Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

Detailed Policy Breakdown

On the next page you are going to get an even deeper break down of the items in your policy on your declaration page.

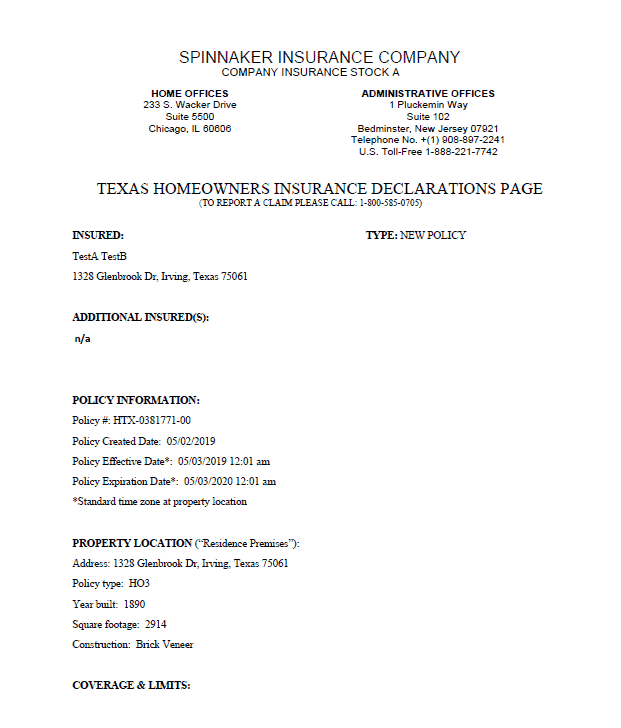

Underwriting Company

You are going to find the exact company that has underwritten your policy on this page along with their mailing addresses.

You will also be shown the state the declaration page was generated in and if it is a new policy or a type of renewal.

Additional Insureds & Property Location

This page will list any additional insureds you may have attached to the policy as well as the exact property location that is being insured.

It is essential to make sure this information is accurate especially for claims purposes.

Policy Coverage Options

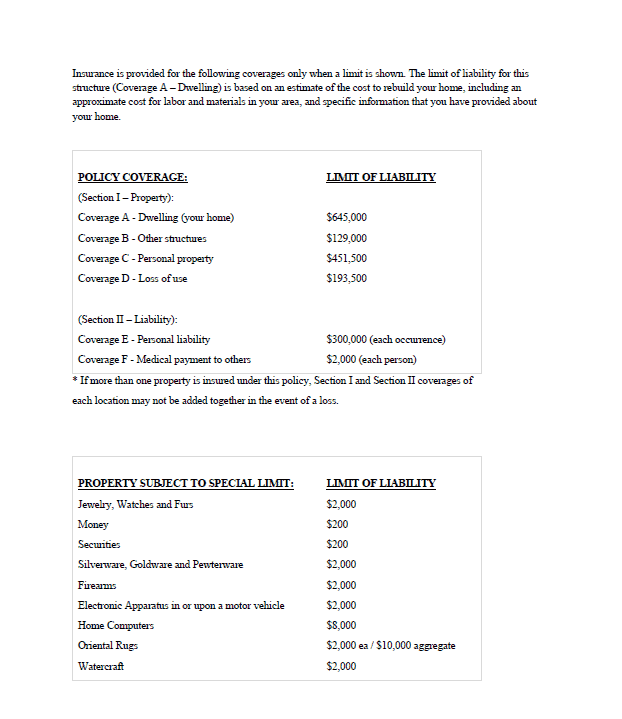

This page is going to go over all of your policy coverage options:

Policy Coverage & Limit Of Liability

This section of the policy is going to show you the property and liability parts of your coverage and the associated coverage amount or "limit of liability" for each part.

As you can see it shows the property benefits for your dwelling, loss of use, personal property, and other structures coverage.

Then it switches over to your liability benefits for your personal liability and medical payments.

It is essential that you learn what all of your limits are to determine if you need more coverage and so you will know what to expect if you have to file a claim.

Property With Special Limits & Limit Of Liability

This section is going to go over any specific property that you have that has its own separate limit of liability.

As you can see these things can be:

You need to be sure you have enough coverage for these specialty items and you should know exactly what will pay out if you encounter a loss.

INSURANCE WHERE YOU LIVE

Home insurance by state.

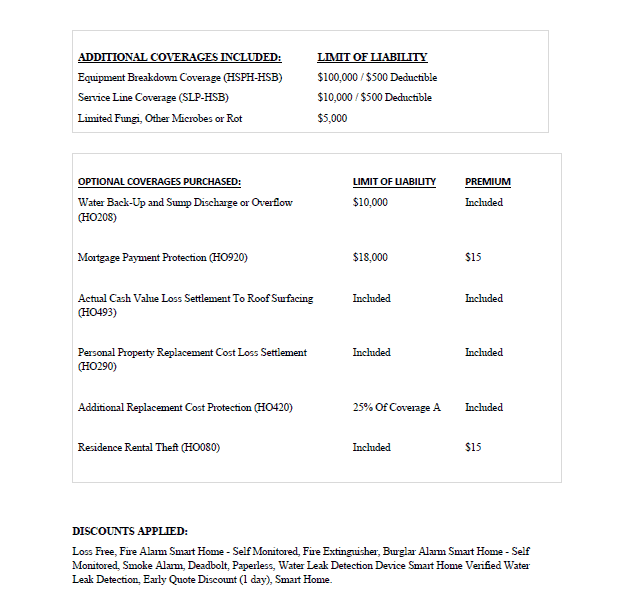

Additional & Optional Coverage Options

The next section of this declaration page is going to cover any additional coverage that is included as well as any optional coverages you purchased.

Additional Coverages Included

This home insurance policy comes with additional benefits that are included at no additional cost.

This page is going to show what those coverages are and the limits associated with them.

Optional Coverage Purchased

With most homeowners insurance policies you can purchase additional and optional coverage.

This section will show which optional coverage you purchased, its limits on liability as well as the monthly premium of the option.

Discounts Applied

If there are any discounts that have been applied to your policy you will see them listed in this section of the declaration page.

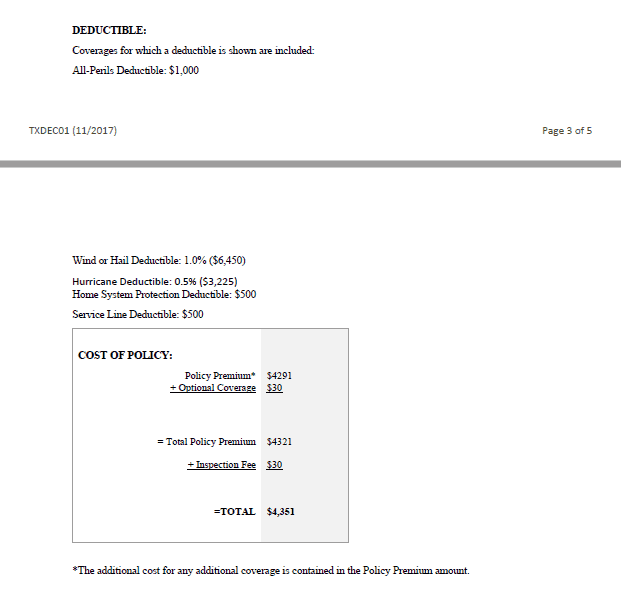

Policy Deductibles & Total Costs

This section is going to go over each of your policy deductibles, what they cover and their limits as well as the total monthly cost of your policy.

Different Deductibles

There are several different deductibles when it comes to a homeowners policy and they are usually:

You can also see what the deductible is for each type of coverage.

Keep in mind that all of these are separate so if you have a service line issue you will need to pay that deductible separate from the wind or hail deductible.

You will also be able to locate how much the deductible will be if you have to file a claim.

The Final Cost Of Your Policy

This section of the declaration page is to simply add up all of the policy benefits as well as additional options you may have purchased to give you the final cost of your home insurance policy.

THE SIMPLY INSURANCE WAY

Home Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

Important Policy Information

This section is about your responsibility as a home owner as well as other important policy information such as exclusions.

Things Not Covered

Like most home insurance policies, earthquakes and floods are NOT covered.

You will need to obtain a different policy for those types of coverage.

Renewals

The terms of your policy renewal can be found in this section.

It is essential to know how and when your policy renews.

You will need to obtain a different policy for those types of coverage.

Non-Payment Notices

If you go out of town and forget to make a payment on your policy, the insurance company can notify someone else of your late premium payments.

This can help prevent your policy from lapsing.

Allow someone else to reach out to you about what is happening with your policy.

I usually recommend a parent or a sibling that doesn't live with you.

Take Action

Hopefully you now understand how to navigate a homeowners insurance declaration page once you purchase your policy.

If you haven't started the search, you should click here to get an instant home insurance quote and immediate coverage. If you already have a policy, you should do the same to compare rates.