Our Top 3 Life Insurance Company Picks

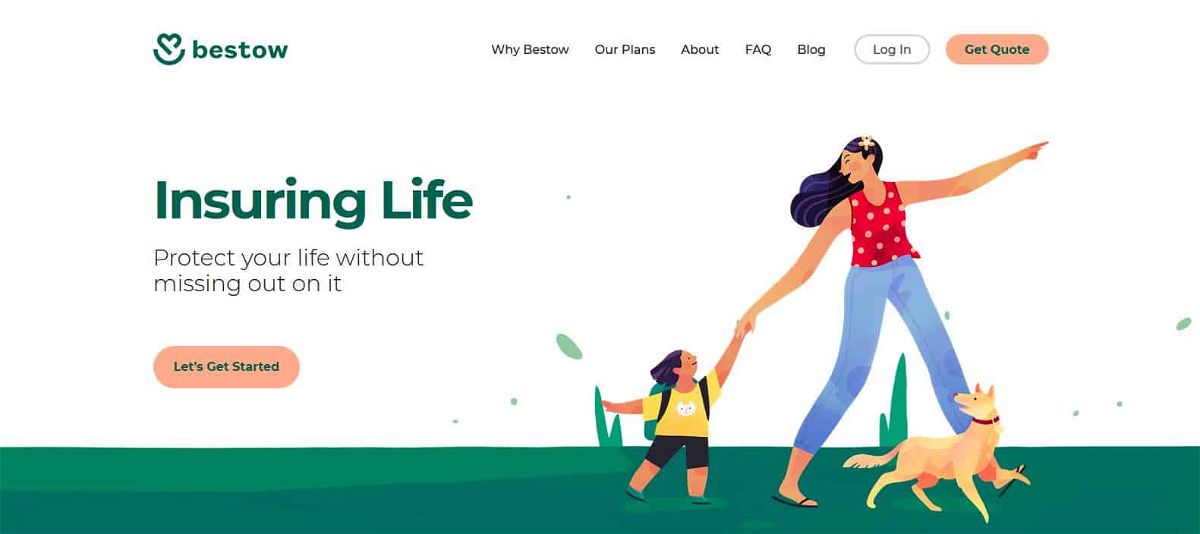

Our #2 Pick

Bestow is backed by A+ rated North American, and is our #2 Pick. Their competitive rates and fast approval process earned it the 2nd spot.

Our #3 Pick

Haven Life is backed by A+ rated Mass Mutual, and is our #3 pick because of their large coverage amounts and an online application.

Our #4 Pick

Fabric is backed by A+ Rated Vantis Life, and is our #4 pick . Very Low Rates, free wills, and a fast approval process earned it the fourth spot.

Picking the best life insurance company can be complicated, and it's hard to know where to start when you have hundreds of companies and policies to choose from.

What if I told you we have taken all of the guessing work out and narrowed it down by comparing the top 10 of the best life insurance companies that pay out in the United States with 3 bonus companies.

In this post we will compare and review these top life insurance companies, explain why they are the best options in 2019 and go over some sample life insurance rates.

Let's get started!

Find Out Who Made Our List of The Top 10 Best Life Insurance Companies.

Plus More Details On Each Company, Why You Need Life Insurance, What Does It Cover, And How To Apply For Coverage.

1. Bestow

5.0

Bestow is our #1 recommended life insurance company based on approval speed and price.

They are the only product on the market that offers a true no exam experience from the application process all the way through to the approval.

If you need affordable life insurance without a medical exam, there is no faster option in the life insurance space today.

Features & Benefits

Why buy coverage from Bestow? Here are just a few reasons they're our favorite...

Bestow has also designed a brand new underwriting framework and built one of the best processes for purchasing life insurance online.

Your application will be underwritten in real time, so, the questions will change and update as you answer one question to the next.

This means that by the end of the application your underwriting is done and your decision is issued instantly.

No other company has an underwriting platform that is designed to function the way Bestow has set theirs up.

Their policies are issued by North American Company for Life and Health Insurance which is rated A+(Superior) by A.M. Best.

Bestow Reviews 5/5

Bestow has received over 100 reviews from verified policy holders, averaging 4.9 out of 5 stars.

In fact, they have an A rating from the Better Business Bureau (BBB), and even though they don't have any reviews on the BBB yet, they have absolutely no complaints filed against them.

Want to learn more? Read our full Bestow review here.

Sample Quotes & Rates

Bestow has some of the lowest rates when it comes to no medical exam term life insurance, check out our sample rates below:

- Bestow Rates For Men

*Rates are based on a 20 Year Term Policy - Non-tobacco Female with a preferred health rating

Age | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keep in mind that the rates are going to be different for everyone based on your exact age but the above rates are pretty close.

As you can see, you can get a ton of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

Pro Tip: If you are a tobacco user your rates are going to be a bit higher and the above sample rates don't apply to you. It is best to click through to see your rates.

Click here to see our guide to buying life insurance, full of tips, strategies and more!

Bonus: It is recommended that you purchase at the least 10x(times) your annual income in life insurance coverage. However, I always like to recommend 15x to 20x(Times) if you can afford it.

Feel free to check out our life insurance calculator to make sure you know how much coverage you should have.

*Rates From $7.75/month (30-Day Free Look Period)

*Rates based on a female in her 20's for a 20 Year, $50,000 term policy in excellent health.

2. Haven Life

4.7

Coming in at a close second to Bestow is Haven Life, another one of the best places to buy no exam life insurance online.

Just like Bestow, Haven Life allows you to purchase life insurance online very fast and you also have the ability for an immediate decision.

Even though they offer a 30 year term, there is a possibility, based on your health, that you might have to take an exam.

Features & Benefits

Some reasons why Haven made the cut:

*Depending on your health you might have to take an exam to be covered.

Haven is also one of the first companies that offers the ability to apply for term life insurance up to $3,000,000 with an easy, online process and without the need to consult an agent.

Through its partnership with MassMutual, they have created a process called InstantTerm, which allows coverage to begin immediately for some qualified applications (up to age 45).

And just like Bestow, their system can underwrite you while you are completing the application for an Immediate Decision. Their policies are issued by MassMutual which is rated A+(Superior) by A.M. Best.

Haven Reviews 4.7/5

Haven life has received over 552 5-Star reviews on Trustpilot, so the overall experience that people are having with them is pretty good.

However, even though they have an A+ rating with the BBB they currently have a 1-star customer review and 2 customer complaints over the last 3 years about the speed of their approval process.

Want to learn more? Read our full Haven Life review here.

Sample Quotes & Rates

Haven life also has very affordable rates when it comes to term life insurance with no medical exam.

- Haven Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Again, keep in mind that the rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to your real rate.

As you can see, you can get a ton of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

Pro Tip: Once you click through any of these insurance companies you can get quotes without giving any personal information.

*Rates From $7.33/month (10-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

3. Fabric

4.7

Fabric has been putting a twist on life policies since it started and along with offering a no exam option for up to $1,000,000 in coverage, they also offer free Personal Wills and all sorts of neat tools to manage your policy.

If you need more than $1,000,000, however, you will have to take an exam.

Features & Benefits

Fabric made the top 3 due to their fast application process, low cost, and the fact that they offer free personal Wills and special tools for policy management:

Like Haven & Bestow, Fabric accesses data, such as your motor vehicle and prescription drug records, and uses predictive analytics to decide whether you qualify and to determine your final cost.

Fabric really wants to add additional focus around the entire idea of life insurance, from purchasing it, to managing it, and to having a personal Will.

They also pioneered a software that allows you to share your policy information with a beneficiary super easy.

Their policies are issued by Vantis Life which is rated A+(Superior) by A.M. Best.

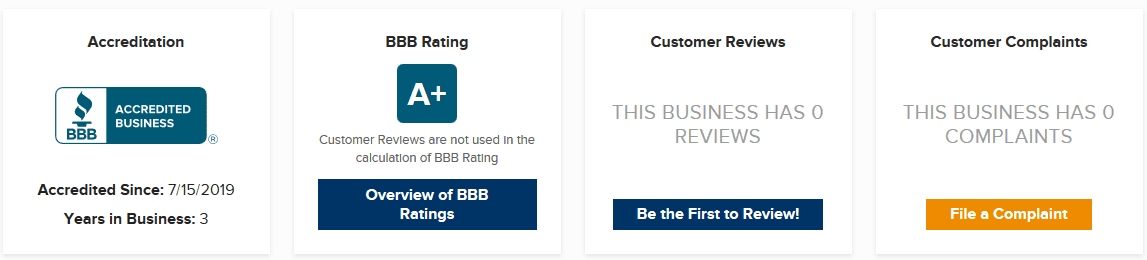

Fabric Reviews 4.7/5

Fabric has received over 1,216 4 & 5 - Star reviews on Trustpilot out of a total of 1,257 ratings, so over 97% of customers that purchased coverage, or obtained a free Will through them have had a great experience.

They have were recently Accredited, and have an A+ rating with the BBB along with 0 reviews and 0 complaints so far.

Want to learn more? Read our full Fabric Life review here.

Fabric No Blood Test Life Insurance Rates

Fabric life is going to have some very affordable prices out of the five carriers we have reviewed and comes with additional benefits like their free Wills.

Below are the sample rates:

- fabric Prices For Men

*Based on a 20 Year Term Policy - Non-tobacco Female with a preferred health rating

Age | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pros Of Fabric No Medical Exam Life Insurance

The largest pro for Fabric is going to be that they want you to be part of an entire 360 life insurance process.

They offer free Wills and a document vault software that allows you to keep your documents safe.

So you can get your life insurance, secure it and put a Will in place all at one time.

*Rates From $9.36/month (10-Day Free Look Period)

*Based on an 21 year old female 10 Year Term, $100,000 term in excellent health.

4. SBLI

4.5

Coming in at a close fourth to Fabric is SBLI, another one of the best places to buy term life insurance online.

SBLI is the first insurance company to change how they issue life insurance policies and have a strong focus on the everyday person begin covered.

They have some of the best rates for any type of medical situation as well as a no exam option available.

Features & Benefits

Some reasons why SBLI made the cut:

SBLI is short for The Savings Bank Life Insurance Company Of Massachusetts and they are over 120 years old which shows us they aren't going anywhere.

They are the first company that focused primarily on the everyday person getting life insurance coverage.

If you are between the ages of 18 and 60 and need $500,000 in life insurance or less you qualify for the Accelerated Underwriting that won't require an exam.

They are rated A (Excellent) by A.M. Best.

SBLI Reviews 4.5/5

SBLI has received over 449 5-Star reviews on Trustpilot, so the overall experience that people are having with them is pretty good.

They have an A+ rating with the BBB and have only 3 reviews posted to the BBB giving them a 2-star customer review.

Want to learn more? Read our full SBLI review here.

Sample Quotes & Rates

SBLI also has very affordable rates when it comes to fully underwritten term life insurance and life insurance for tobacco users.

- SBLI Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Again, keep in mind that the rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to your real rate.

As you can see, you can get a ton of coverage for a cheap rate, to get the best rate you should look at different term lengths and coverage option combinations.

*Rates From $7.53/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

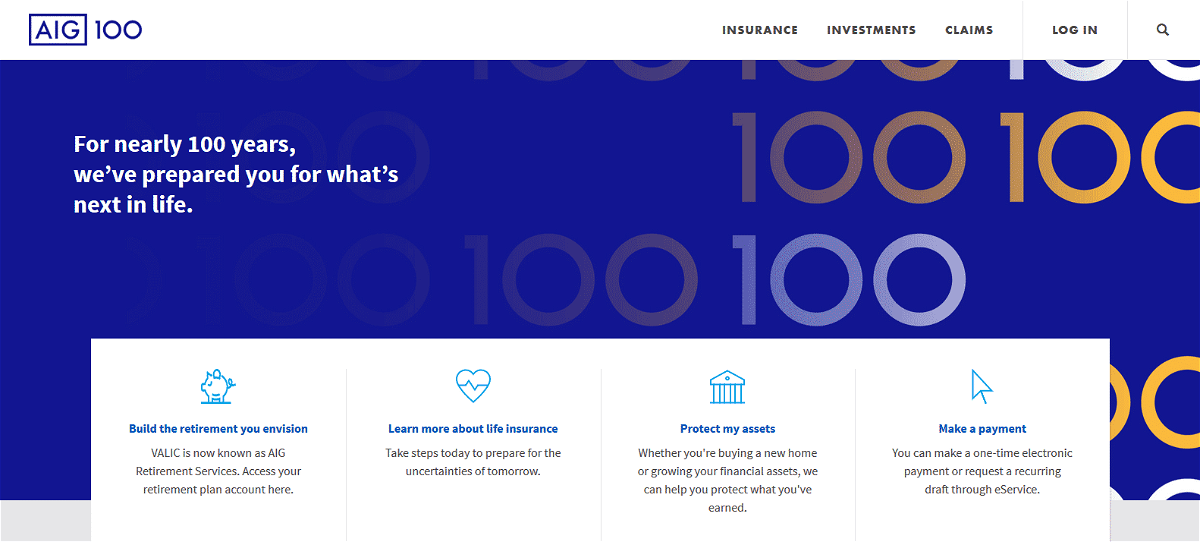

5. AIG & AIG Direct

4.0

AIG makes it in at 5th place for being another one of the best places to buy life insurance.

What makes AIG stand out is the ability to have non-standard term lengths. For example, you can choose a term of 18 or 19 years instead of the usual 20 year term.

You can also customize your policy with a wide range of riders.

Features & Benefits

Some reasons why AIG made the cut:

American International Group or AIG Life was founded in December of 1919 which makes it 100 years old.

They are one of the largest life insurance companies in the world and are operating in more than over 80 countries,

AIG Life Insurance Company has a rating of A (Excellent) from A.M. Best.

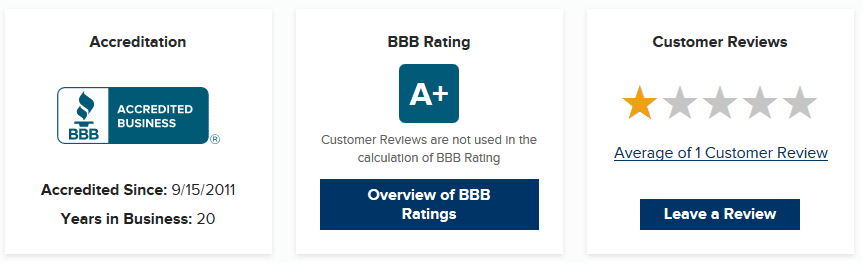

AIG Reviews 4.0/5

AIG has an A+ rating with the BBB and also a 1-star review based on 1 customer review.

AIG In general has dealt with a bail out in the past; however, they have paid back all the money borrowed as well as all of the interest.

The AIG life insurance division doesn't currently have any complaints but entire AIG company does have a different BBB Profile with different complaints.

Want to learn more? Read our full AIG review here.

Sample Quotes & Rates

AIG also has very affordable rates when it comes to fully underwritten term life insurance.

- SBLI Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remember that rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to your real rate.

You can get a large amount of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

*Rates From $14.00/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

6. Protective Life

4.2

Coming in at a strong sixth place to AIG is Protective Life, Protective is another great place you can purchase life insurance from.

They offer a wide verity of insurance products and additional insurance riders.

Even through their underwriting process is longer than average, they still have some of the most lenient underwriters in the industry for pre-existing conditions.

Features & Benefits

Some reasons why Protective made the cut:

Protective Life was founded in 1907 which makes it 112 years old, and hey believe in doing what's right, always, and living with integrity and honesty.

They underwrite their own policies as well as for their subsidy properties and have a financial strength rating of A+(Superior) by A.M. Best.

Protective is offering up to $10 Million in life insurance coverage with a short online application, as well as multiple permanent life insurance products.

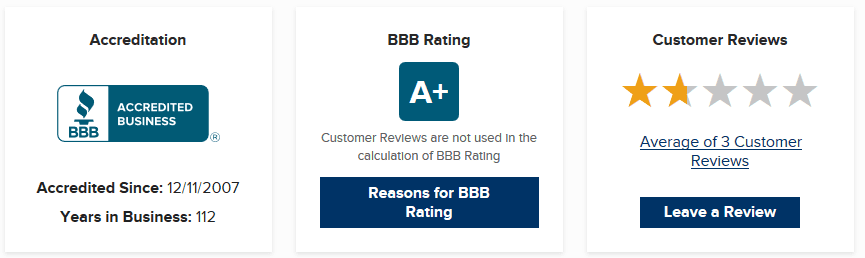

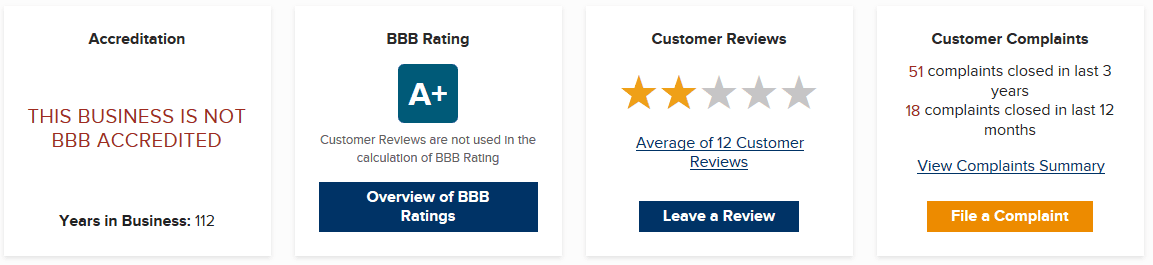

Protective Reviews 4.2/5

Protective is not a BBB Accredited business; however, as you can see they have answered over 51 complaints in the last 3 years and 18 in the last 12 months.

Even though they have an A+ rating with the BBB they currently have a 2-star review based on 12 customer reviews.

Want to learn more? Read our full Protective Life review here.

Sample Quotes & Rates

Protective life also has very affordable rates for people with pre-existing conditions and for people who are fine with taking an exam.

- protective Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Again, keep in mind that the rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to your real rate.

As you can see, you can get a ton of coverage for a small rate, to get the best rate you should look at different term lengths and coverage option combinations.

*Rates From $11.00/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

7. Pacific Life

4.1

Taking up our 7th space is Pacific Life, another one of the best places to buy no exam life insurance online.

Pacific Life has the best rates for people without any health issues and have an above average approval speed and some of the most affordable rates in the industry overall.

Features & Benefits

Some reasons why Pacific Life made the cut:

Pacific Life was founded in 1885 which makes it over 150 years old, and they are also the 4th largest U.S. life insurance company in sales.

Pacific Life has an A+(Superior) by A.M. Best.

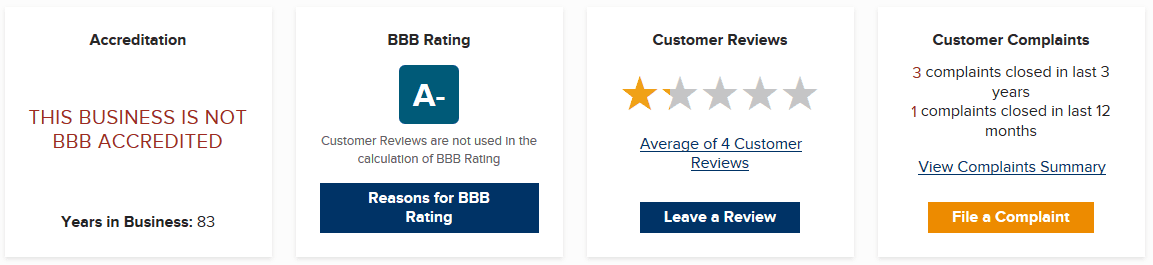

Pacific Life Reviews 4.1/5

Pacific Life has an A- rating with the BBB and they currently have a 1-star review from 4 customers.

They aren't an Accredited BBB business and have had 4 complaints over the last 3 years.

Pacific life seems to have a strong level of customer service and fast response times.

Want to learn more? Read our full Pacific Life review here.

Sample Quotes & Rates

Pacific life also has very affordable rates for people who are younger and can also give reasonable rates to people with pre-existing conditions.

- protective Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to what your final rate could be.

As you can see, you can get a ton of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

*Rates From $10.00/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

8. Lincoln Financial Group

4.0

In eighth place we have Lincoln Financial, another one of the best places to buy life insurance online.

Lincoln Financial has some of the most competitive underwriting tables for an assortment of health conditions, making them the best life insurance for someone with substandard medical situations.

However, completing the application can be a long process even though the approval process is faster than usual.

Features & Benefits

Some reasons why Lincoln Financial made the cut:

Lincoln Financial was founded in 1905 which makes it over 114 years old and If you are wondering if Lincoln financial has anything to do with President Abe Lincoln you would be right.

The owners of the company were able to get permission from Abraham Lincoln's Son to use his name and likeness for the logo since 1905.

Lincoln Financial has an A+ (Superior) ranking with A.M. Best.

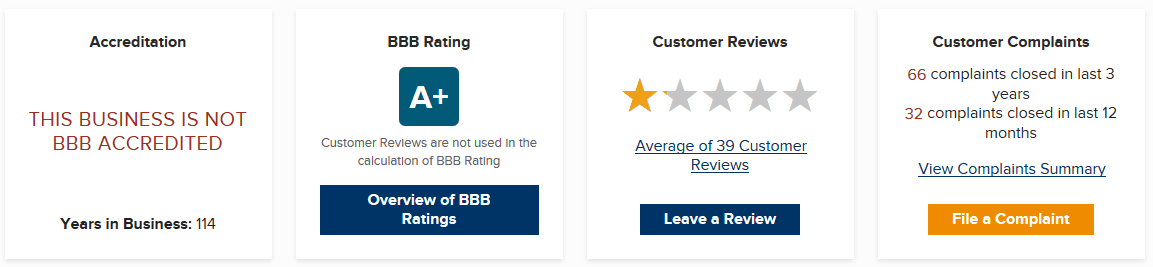

Lincoln Financial Reviews 4.0/5

Even though Lincoln has an A+ rating with the BBB they currently have a 1-star review from 39 customers and have had over 60 complaints in the last 3 years.

It seems that most businesses that aren't part of the BBB have several complaints.

If you take into consideration they have been around over 114 years, I guess only 66 complaints can't be that bad.

Want to learn more? Read our full Lincoln Financial review here.

Sample Quotes & Rates

Lincoln Financial also has very affordable rates when it comes to term life insurance with substandard health.

- protective Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Again, keep in mind that the rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to your real rate.

As you can see, you can get a ton of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

*Rates From $11.00/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

9. Banner Life

4.0

Our 9th runner up is Banner Life, another one of the best places to buy life insurance online.

They have very competitive underwriting for a range of health conditions, including more favorable ratings for people in the substandard health class.

Even through their underwriting process is about average - probably at least 15 days, they have some of the best rates for smokers in the industry.

Features & Benefits

Some reasons why Banner Life made the cut:

What makes Banner Life Insurance Company different is that they offer life insurance up to age 95 which is well above the industry standard of ages of 65 or 75.

They also offer very flexible payment options and multiple term limits for each policy type.

Banner Life was founded in 1949 which makes it 70 years old and is a subsidy of the parent company for Legal & General America and is known for their strong financial standing and great customer service.

Banner Life Insurance Company has a rating of A+ (Superior) from A.M. Best.

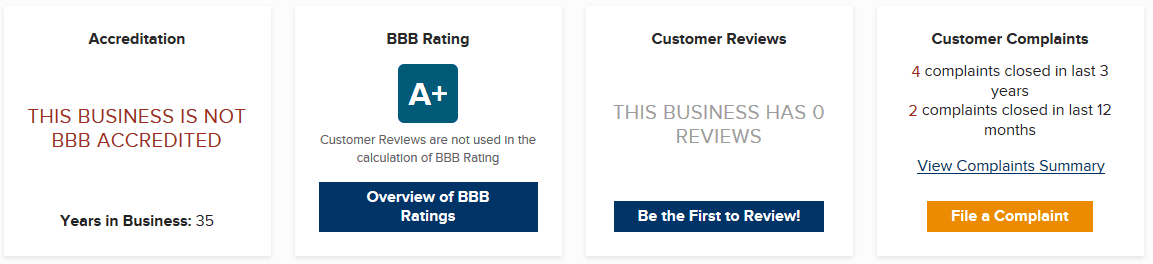

Banner Life Reviews 4.0/5

Banner life, also known as Legal & General America has received over 619 5-Star reviews on Trustpilot, so the overall experience that people are having with them is pretty good.

However, they aren't currently accredited with the BBB and have an A+ rating and 0 reviews.

Over the past 3 years they have had a total of 4 complaints.

Want to learn more? Read our full Banner Life review here.

Sample Quotes & Rates

Banner life also has very affordable rates when it comes to term life insurance with substandard health classes.

- protective Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depending on your exact age and health, your life insurance rates will be different because life insurance is underwritten on an individual basis.

As you can see, you can get a ton of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

*Rates From $7.68/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

10. Mutual Of Omaha

4.0

Mutual Of Omaha takes the 10th spot as another one of the best places to get life insurance online.

Mutual Of Omaha has been named one of the best companies in America to work for and they have some of the most affordable rates in the industry.

They also have some of the best rates for someone with Sleep Apnea and strong customer service records.

Features & Benefits

Some reasons why Mutual Of Omaha made the cut:

What makes Mutual Of Omaha different is that they are owned by their policy holders.

This means that a surplus may be distributed to policyholders in the form of dividends or retained by the insurer in exchange for reductions in future premiums.

Mutual Of Omaha was founded in 1909 which makes it over 110 years old and they are known for their great reputation.

Mutual Of Omaha has an A+ (Superior) rating with A.M. Best.

Mutual Of Omaha Reviews 4.0/5

Mutual of Omaha has an A+ rating with the BBB and has been Accredited since 1940.

They currently have a 1- 1/2 star review from 7 customers with 0 complaints. 2

Want to learn more? Read our full Mutual Of Omaha review here.

Sample Quotes & Rates

Mutual Of Omaha also has very affordable rates when it comes to term life insurance with no medical exam.

- protective Rates For Men

*Rates are based on a non-tobacco female with a preferred health rating looking for a 20 Year Term.

AGE | $250,000 | $500,000 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As you can see, you can get a ton of coverage for a very affordable rate, to get the best rate you should look at different term lengths and coverage option combinations.

Please remember that the rates are going to be different for everyone based on your exact age and health but the above rates are pretty close to your real rate.

*Rates From $9.07/month (30-Day Free Look Period)

*Rates based on an 18 year old female buying a 10 Year $100,000 term policy, she is in excellent health and a non-tobacco user.

Who Should Buy A Term Life Policy?

Everyone needs life insurance coverage, but especially if you are:

Term life insurance is going to be the best way to protect the financial future of your family.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get life insurance coverage within minutes of getting your quotes and applying.

How Much Does Term Life Insurance Cost?

As you can see from above, the average monthly premium for a term life policy around $30. Your premium cost will depend on several factors that include:

Of course, the policy and amount you select and the provider you choose to work with will also play parts in determining your price.

INSURANCE WHERE YOU LIVE

Life insurance by state.

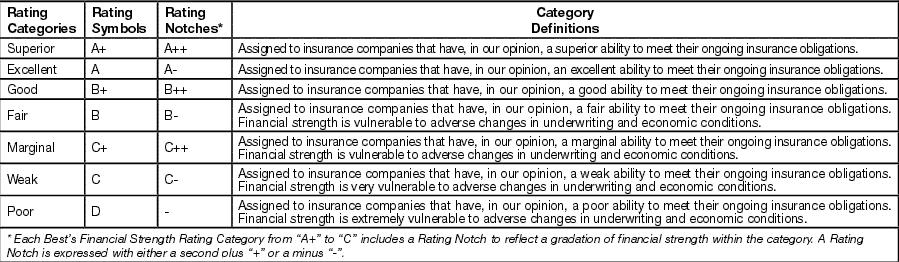

" data-uw-styling-context="true">Term Life Insurance Company Ratings

Financial standings and ratings are one of the most important factors mentioned above when trying to determine which life insurance company to choose.

This is because their rating is determined based on their financial health and claims paying history and ability.

You want to be sure that you are with a company that will be able to pay their claims if you pass away.

Below is a chart showing how A.M. Best rates insurance companies.

Take Action

So there you have it, the 10 best life insurance companies in 2019 with a few added bonuses.

I hope you all enjoyed our review and are more educated on which company will work best for you with no exam life insurance.

Be sure to get covered as soon as it is possible and feel free to apply to more than one company if you can't decide which one to choose, because it doesn't cost anything to apply.

Click here or on any of the above buttons to get covered today.